Photo: Deposit Photos

By Lindsay Engle

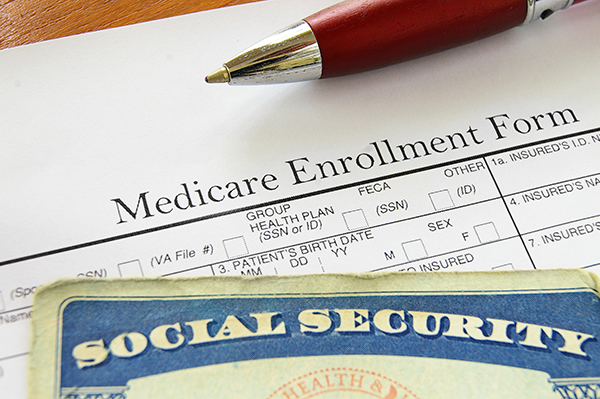

Medicare’s annual enrollment period began on October 15 and ends on December 7th. Have you reviewed your insurance plan? Do you know about the changes being applied to Medicare in 2021? These changes cover budget updates, lowered drug costs, premium changes, and much more, leaving many beneficiaries with a lot to consider before deciding to keep or change their current Medicare plan.

However, first things first: Beneficiaries must understand what the annual enrollment period is, what changes they can make at this time, and how to weigh their decisions before fully understanding how the 2021 changes can affect their coverage. Let’s dive in …

What Is Medicare’s Annual Enrollment Period?

The Medicare annual enrollment period, also known as the Medicare open enrollment period, happens every fall to enable beneficiaries enrolled in Medicare, Medicare Advantage, or Part D to make changes to their current coverage, which will then go into effect the following year. For 2021 Medicare coverage, the annual enrollment period runs from October 15, 2020, to December 7, 2020, for your coverage to begin in January 2021.

What Changes Can You Make?

- Beneficiaries can make several changes during the annual enrollment period, including:

- Switching from Medicare to a Medicare Advantage plan.

- Swapping one Medicare Advantage plan for another.

- Disenrolling from a Medicare Advantage plan and enrolling in original Medicare.

- Enrolling in a Medigap plan if switching back to original Medicare.

- Signing up for a prescription plan through Part D

- Switching from one Part D plan to another if already enrolled.

- Canceling your Part D coverage altogether.

How Can I Determine if Changing Is Necessary?

First, you’ll want to see what changes, if any, will be made to your current coverage in the coming year. Medicare Advantage and Part D benefits change every year, whereas original Medicare changes less frequently. Regardless, any changes will be documented the Medicare Annual Notice of Change Letter, which is mailed to beneficiaries every September. This letter will let you know whether your premium, copays, pharmacy networks, and drug formulary are changing in the upcoming year.

If you’re happy with the changes outlined in the Medicare Annual Notice of Change Letter, there’s nothing you need to do during open enrollment. Your coverage will automatically renew. However, some reasons beneficiaries do decide to make changes after receiving this letter include:

- They receive significant increases in their premiums or deductibles.

- Doctors of choice are no longer in-network under their current Medicare Advantage plan.

- Their medication is no longer included on the list of covered drugs under the drug formulary.

- They need a new plan that offers a better value or offers more comprehensive coverage.

What Should I Consider if I’m Changing Coverage?

If you decide to make a change to your Medicare coverage, you’ll want to make sure whatever changes you make will best suit your health care needs. To do so, there are a few important questions to ask yourself to help determine which plan will provide the coverage and support you’re looking for.

First, you’ll want to determine what your predicted annual medical costs are going to be. Put together a list of expected doctor visits and procedures you’ll need over the next year and estimate what that will cost out of pocket with your current Medicare plan. Then add what you’ll pay in premiums, and that will give you an accurate estimate of your health care costs in 2021. This is a good exercise to do with alternative Medicare plans you’re considering switching to in order to compare total costs.

Next, you’ll want to consider how often you’ll be traveling in the coming year. If you’ll be traveling frequently, it might make sense to delay care until you’re settled in your primary home if leaning toward Medicare Advantage. But if you live in two different states or travel often, you’ll want a plan with a nationwide network or original Medicare, which does not have provider networks.

Another consideration to keep in mind is if you want a plan that provides coverage for vision, dental, and hearing benefits. Original Medicare does not provide coverage for these services, but some Medicare Advantage plans do, although these benefits may not be as comprehensive as some would like, which may lead some to enroll in Medigap.

Lastly, you’ll want to evaluate your current plan ratings through The Centers for Medicare & Medicaid Services star rating system. Medicare Advantage and prescription plans are rated on a scale of one to five stars, with five being the highest. If your current plan has a low rating, it may be time to consider a better plan.

What 2021 Changes to Medicare Should I Know About?

Now that you’ve taken these steps to help determine whether your current plan provides the coverage you need for the year ahead or if you’ll need to change plans, it’s time to factor in how the changes coming to Medicare in 2021 will affect this decision.

The biggest change coming to Medicare next year is President Donald Trump’s new budget that aims to decrease Medicare spending by 7% between 2021 and 2030, which has pros and cons for beneficiaries. One pro is enabling beneficiaries to see nurse practitioners as a primary caregiver, but one con is that many beneficiaries could see a reduction in their reimbursement rates.

However, one overwhelmingly positive outcome of this new budget is the “comprehensive drug pricing reform,” which is estimated to reduce the federal deficit by $135 billion over the next 10 years. This has enabled beneficiaries with diabetes to join Medicare plans that have caps on insulin pricing to prevent copays from exceeding $35 per month.

In terms of Medicare costs for next year, it’s estimated that Part B premiums will cost around $150 per month, according to a projection from CMS, but the final amount will be disclosed in the fall.

What About 2021 Changes to Medicare Advantage?

Two of the major changes coming to Medicare Advantage plans in the coming year are the expansion of coverage for telehealth services and coverage for long-term care benefits, including adult day care services, in-home personal care services, and home safety modifications.

Another big change from the 21st Century Cures Act is that beneficiaries with end-stage renal disease can now enroll in Medicare Advantage plans starting next year, providing them with more coverage options through Medicare. Up to this point, individuals with ESRD could enroll in Advantage plans only under limited circumstances.

Be Prepared

Be sure to take all these necessary steps and carefully review all available information when choosing to keep or change your Medicare coverage during open enrollment. It’s also a good idea to become familiar with additional 2021 enrollment periods to see when and what other changes you’ll be able to make throughout the year. If you’re still uncertain about which plan is best for you and your eligibility for the enrollment periods, consult with a professional who can help you make informed decisions that best meet your health care needs.