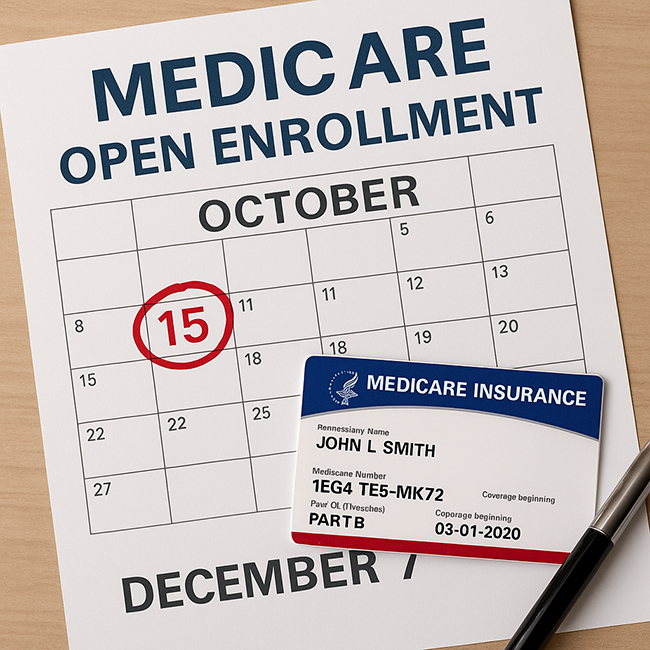

When is the Medicare Annual Enrollment Period?

Medicare’s Annual Enrollment Period (AEP) runs from October 15 through December 7, 2025, giving current beneficiaries the chance to review, compare, and change their coverage.

Even if you’re satisfied with your current plan, experts recommend checking your options every year. Insurance companies frequently adjust premiums, provider networks, and drug formularies. What worked well for you last year may not be the best fit in 2025.

Here are the key facts you need to know this season, along with resources to help you make informed choices.

Medicare Open Enrollment 2025: Important Dates and Deadlines

October 15 – December 7, 2025:

The Medicare Open Enrollment period. Any changes you make will take effect January 1, 2026.

January 1 – March 31, 2026:

The Medicare Advantage Open Enrollment Period. During these three months, if you are already enrolled in a Medicare Advantage plan, you may switch to a different Advantage plan or return to Original Medicare.

Missing these deadlines can lock you into a plan for the year, unless you qualify for a Special Enrollment Period due to life events such as moving, losing other coverage, or qualifying for Medicaid.

For a detailed calendar of enrollment periods, visit Medicare.gov.

What You Can Do During Open Enrollment

Open enrollment is your chance to make meaningful changes to your coverage. During this window, you can:

- Switch from a Medicare Advantage plan back to Original Medicare.

- Switch from Original Medicare (Part A and Part B) to a Medicare Advantage (Part C) plan.

- Change from one Medicare Advantage plan to another.

- Enroll in, drop, or switch a Part D prescription drug plan.

It’s important to note that open enrollment is not the time to purchase a Medicare Supplement (Medigap) policy. Those policies are available when you first become eligible for Part B, or under certain circumstances later. If you are already in a Medicare Advantage plan, you typically cannot purchase Medigap coverage. See Medicare.gov’s Medigap section for details.

Key Changes for 2025

This year brings some of the most significant improvements to Medicare in decades, due to provisions of the Inflation Reduction Act.

$2,000 Cap on Prescription Drug Costs

Starting in 2025, out-of-pocket costs for covered prescription drugs under Part D will be capped at $2,000 per year. This change offers substantial relief for people who rely on expensive medications. Learn more from the Centers for Medicare & Medicaid Services (CMS).

Monthly Payment Option for Prescriptions

Beneficiaries may opt into the Medicare Prescription Payment Plan, new in 2025, which allows you to spread out your prescription drug costs in monthly installments rather than paying large sums all at once.

Changes for Dual-Eligible and Extra Help Beneficiaries

If you qualify for both Medicare and Medicaid, or receive Extra Help with drug costs, new rules beginning January 2025 will change how often you can switch plans. The KFF (Kaiser Family Foundation) provides a detailed overview of these updates.

Should You Use an Agent or Go It Alone?

One common question is whether it’s better to work with a licensed insurance agent (sometimes called a broker) or to make changes directly through Medicare.gov.

Working with an agent:

- Agents can explain differences between plans and may help simplify a confusing process.

- They do not charge you directly—commissions are paid by the insurance companies.

- However, most agents only represent certain insurance companies. This means they may not show you every plan available in your area.

Doing it yourself:

- The Medicare Plan Finder allows you to compare all available plans in your ZIP code, including costs, drug coverage, and participating providers.

- You remain in full control of your decision and see the entire marketplace of options.

- But it can be time-consuming, and the system may feel overwhelming if you are not comfortable with online tools.

A balanced approach:

- Many experts recommend starting with the Medicare Plan Finder to get a sense of your options.

- Then, if you feel uncertain, you can consult with an agent or better yet, seek free unbiased help from your State

Health Insurance Assistance Program (SHIP). SHIP counselors are not paid by insurance companies and can provide neutral advice. Find your state’s SHIP here.

Why Reviewing Your Plan Matters

Even with these improvements, it’s crucial to review your plan carefully. Each fall, your insurer must send you an Annual Notice of Change (ANOC). This document outlines any changes to premiums, deductibles, copays, provider networks, and drug coverage. If you haven’t received your ANOC by late September, contact your plan directly.

The National Council on Aging (NCOA) recommends paying special attention to:

- Are your doctors and hospitals still in-network?

- Are your prescriptions still covered, and at what cost?

- Have premiums, deductibles, or copays increased?

- Are supplemental benefits (such as dental, vision, or hearing) changing?

Find step-by-step guidance in NCOA’s Medicare enrollment resources.

Original Medicare or Medicare Advantage: Which Is Better?

One of the most common—and most confusing—questions during open enrollment is whether Original Medicare or Medicare Advantage is the better choice. The truth is, neither is universally “better.” The right option depends on your health needs, budget, and lifestyle.

Original Medicare (Parts A & B)

- Flexibility: You can see any doctor or hospital in the U.S. that accepts Medicare—no networks or referrals required.

- Nationwide Coverage: A good choice for people who travel often or split time between states.

- Pair with Medigap: Supplemental (Medigap) insurance can cover deductibles and coinsurance, offering strong financial protection if you face serious illness or frequent care needs.

Considerations: You’ll need to buy a separate Part D plan for prescriptions. Premiums for Medigap can be higher, and extras like dental, vision, and hearing aren’t included.

Medicare Advantage (Part C)

- All-in-One Plans: Most Advantage plans bundle hospital, medical, and prescription drug coverage, and often include extras like dental, vision, hearing, and fitness benefits.

- Out-of-Pocket Limit: Plans cap what you pay for covered services each year—something Original Medicare doesn’t do.

- Lower Premiums: Many Advantage plans offer low or even $0 monthly premiums (beyond the standard Part B premium).

Considerations: You are generally limited to network providers, and referrals or prior authorizations are common. This can restrict access to specialists or top hospitals. Benefits and provider networks may change year to year.

Which Is Better If You Have a Serious Illness?

If you want maximum freedom to choose your doctors—especially specialists at leading hospitals—Original Medicare with a Medigap policy usually provides more flexibility and fewer delays. Medicare Advantage can work if your doctors and hospitals are in-network, but approvals and network limits can be hurdles for complex care.

Bottom Line

- Choose Original Medicare if you value flexibility, travel frequently, or want the option to see top specialists without network restrictions.

- Choose Medicare Advantage if you want bundled coverage, extras like dental/vision, and lower premiums—and are comfortable staying within a managed care network.

For a side-by-side comparison, visit Medicare.gov.

Tools and Resources to Help You Decide

• Medicare Plan Finder

• State Health Insurance Assistance Programs

• Medicare Interactive (MedicareInteractive.org)

Smart Steps for Beneficiaries

- List your current doctors, prescriptions, and preferred pharmacies.

- Compare your current plan against at least two alternatives.

- Check for changes in drug coverage tiers.

- Confirm provider networks.

- Seek unbiased advice from SHIP if needed.

- Don’t wait until December.

The Bottom Line

Medicare is an essential safety net for older adults, but it’s not a one-size-fits-all program. Each year, open enrollment is your opportunity to ensure your coverage matches your health needs and budget. With significant new protections coming in 2025—particularly the $2,000 cap on drug costs—now is the time to review your plan and take full advantage of these benefits.

Whether you choose to rely on an agent, do it yourself, or seek free counseling, the key is to take action. Being proactive can save you money, reduce stress, and give you peace of mind about your healthcare in the year ahead.

For the most up-to-date information, always start with Medicare.gov.